Ordinary money—the kind that is printed by central banks—is so polluted with greed and crime, on a global scale, and is so irretrievably in the control of the ultrarich and the legions of crooked lawyers and bankers and politicians who serve them, that the rest of us can no longer escape being ripped off incessantly and from multiple angles every single day. The ethos of corporate profiteering and skimming is ingrained so deeply into the fabric of money itself that there is virtually no financial transaction in your life that is free of the taint of corruption.

This means that nearly everyone is working far too hard for the regular money that the rich are able to steal with impunity, in amounts now measured in trillions. The money buys the congressmen and pays for yet more crimes, for fortunes hidden overseas, for markets cornered, for ridiculous swindlers who turn up to preen in their sad government-subsidized finery at the festival and the gala and the rocket launch.

Money is the steel trap clamped around the throat of the world. It’s in this context that any serious conversation about cryptocurrency or blockchain has to begin, because the first real cryptocurrency, bitcoin, was launched in 2009 as an explicit attempt to pry the jaws off. Is it working, LOL hell no not yet.

As soon as bitcoin became worth stealing, criminals, central bankers, hedgies, VCs and other common grifters rushed right in to try to corrupt it in the usual way. Simultaneously, a ton of people set about refining and improving the underlying blockchain technology. Entrepreneurs of wildly varying ethical standards eventually made it safer and more efficient to use, store and trade crypto. They launched new blockchains, new cryptocurrencies and crypto tokens. At the time of writing, an increasing number of these new blockchains no longer rely on energy-intensive proof of work (PoW) calculations, as Bitcoin does, to verify their records. Bitcoin itself has become more efficient, with each formal transaction now able to represent many thousands of subsidiary ones. Also people have started using blockchain for all kinds of things like permanently archiving news articles, trading rooftop solar energy, improving bond issuance, simplifying bills of lading, and keeping track of data in clinical trials. Yes also Beeple. An insane amount of innovation is happening at this very moment, good and bad things that we will talk about. Do I have any crypto, stick around and find out. I will even share “hot tips,” perhaps!

Anyway some of the bad things people say about crypto are true, and many more are not, but the stone cold fact is that the underlying blockchain technology that powers it is one of the very few weapons that regular people can use to fight income inequality, censorship, the global panopticon and looming authoritarianism. This is because public (but not private!), properly distributed blockchains—the kind that anyone on the internet can join and operate—produce incorruptible records.

But for sure whatever is bad about crypto is worse with respect to ordinary money, because (a) there’s vastly more money than there is crypto, and (b) because, in the case of money, gross disgusting people have had centuries not only to figure out how to cheat, but how to cover their tracks, devise pretenses to respectability, weasel their way into public office, and so forth.

Tomorrow let’s take on the issue of Bitcoin mining and energy use!! I can’t wait. Lord!

In closing, a story from way back in the before time.

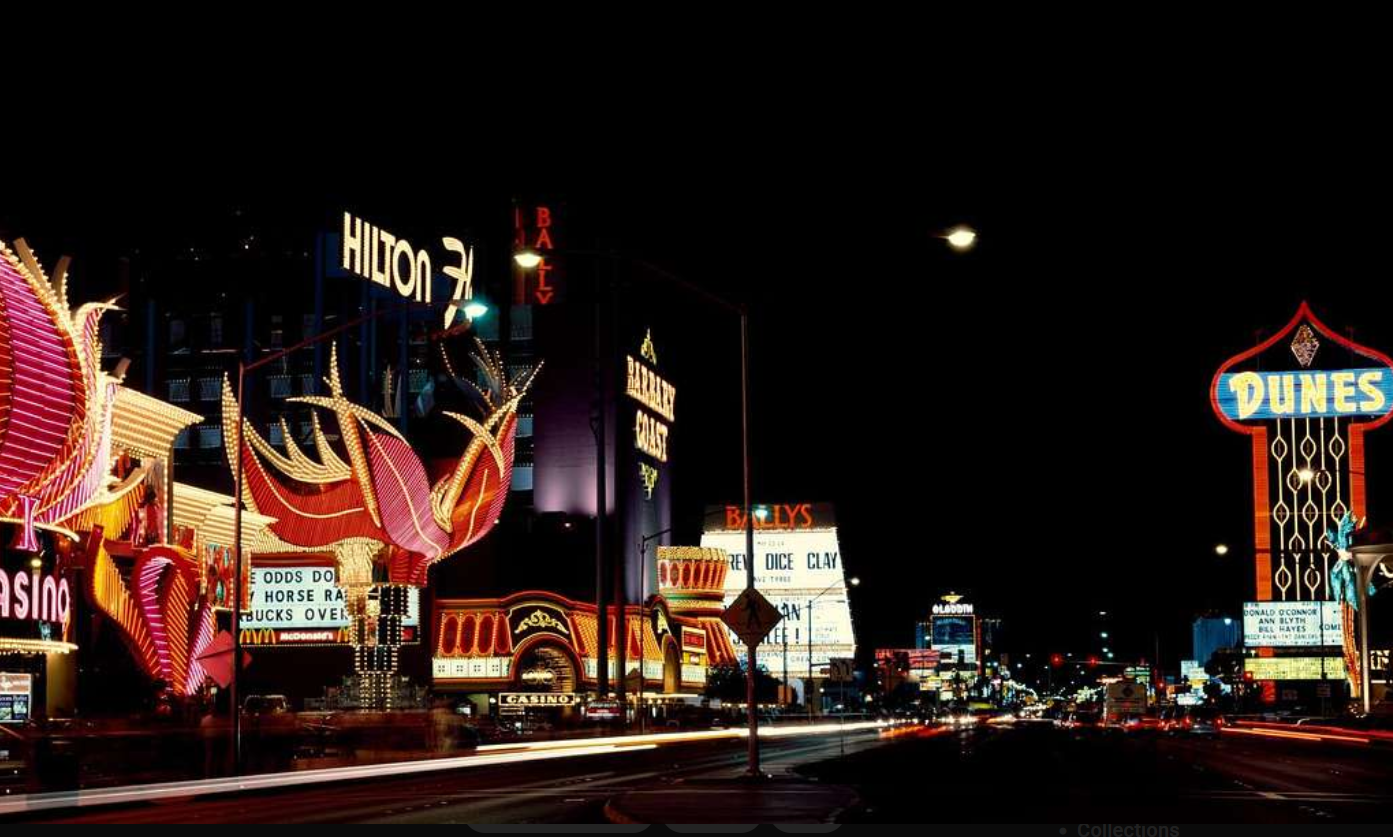

When I turned 21 my parents took me and my then-husband to Las Vegas for a birthday weekend, and it was extremely fun, particularly the night my dad taught me to play craps and I hit a hot streak and everyone at the table was all betting with me, raking it in and screaming for joy; I was wearing a “midi-length” floral silk crepe dress with a heart neckline, and I had a bunch of points on the table and just kept making them all, roll after roll. At some stage this guy in a gigantic ten-gallon hat shouted, “Come on honey, let’s see them Dolly Partons!” and damned if I didn’t roll a two, causing the whole place to go berserk. A blissful moment, to which I attribute my lifelong love of gambling. Afterward, that friendly cowboy tried to give me a black chip—$100, a fortune to me, a college student in the early 80s—but my dad wouldn’t let me accept it (patriarchy).

I’m a careful gambler, having always followed my late parents’ advice, which is pretty standard-issue: gamble only what you can afford to lose, in fact write the money off before you place your first bet; consider it part of the cost of your holiday, and manage your stakes accordingly. In this way I have enjoyed a long and pleasurable life of modest, calculated vice. Which, obviously, is not what Las Vegas is about. Las Vegas is unsustainable, as a place and as an idea, built on a disastrous sense of excess, a red-hot, nakedly explicit desire for too much.

Many years after my 21st birthday I befriended a union organizer and state assemblywoman in Las Vegas who’d worked in the casinos, and she told me in no uncertain terms that Las Vegas would not exist without gambling addiction. A sobering thought, that my own (as I thought) harmless vice was maybe not really harmless.

Do I think gambling should be illegal, no, I don’t. I don’t know what I think about it.

But I asked my dad once: If you added up all you’ve gambled, all you’ve lost and all you’ve won, would you be ahead?? And he laughed and said no.

Boom Times is a blog about gambling, luck, money, greed, investing, blockchain technology and cryptocurrency.