Hello! Today we’ll begin addressing the thorny question of crypto mining and energy use. Yay! (For the purposes of this blog I will be using the word “crypto” to mean both currency and blockchain projects of various kinds, specifying exact projects and tokens as needed).

Some crypto projects, like Bitcoin, use a lot of energy, it’s true. How much?

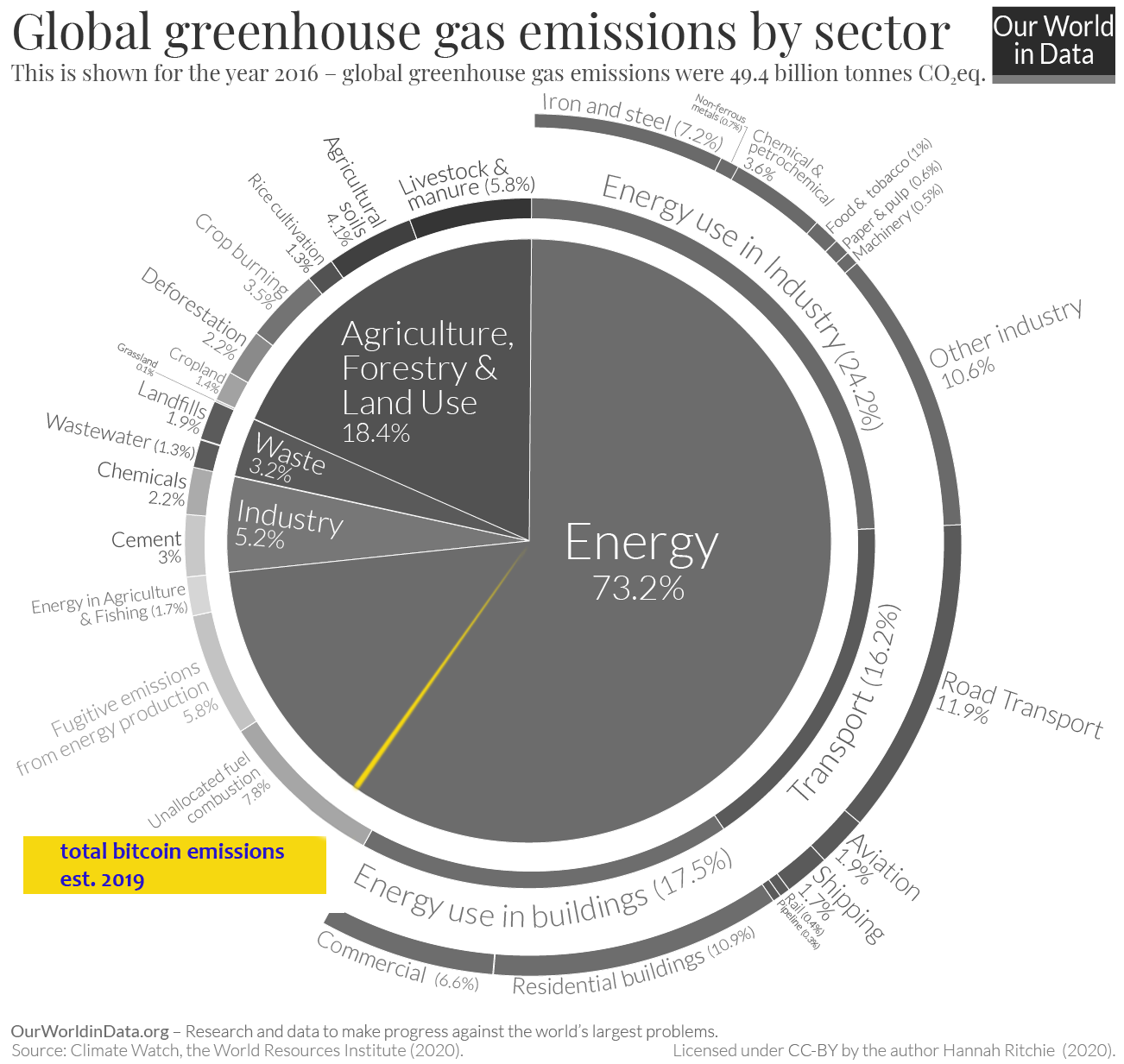

The chart above shows emissions for the year 2016, representing a total of 49.4 billion tonnes of greenhouse gas emissions; the 2019 figure was estimated at 52.4 billion tonnes. (Emissions matter more than energy use, because it’s greenhouse gases that are killing the planet, not energy use.) There was a substantial drop in 2020, the pandemic year, so we can assume that this chart is close enough for our purposes. The yellow slice of the pie shows Bitcoin’s estimated annual share of greenhouse gas emissions, somewhere around 23 megatonnes of CO2, according to a 2019 estimate at Joule. (It’s difficult to get an exact estimate, all the more so since China cracked down on mining activity there, forcing miners to flee all over the globe; emissions can only be calculated accurately when you know the source of the power. Also, it’s important to remember that Bitcoin energy costs don’t rise with transaction volume; it’s the competition between miners that determines energy expenditure, and that’s affected by a ton of different factors, from politics to hardware costs.)

In any case, what crypto critics routinely fail to mention is that crypto mining can use up “stranded” fuel assets that would otherwise be burned to create more emissions. The Cambridge Bitcoin Energy Consumption Index points out that excess gas flaring, if it were captured instead and put to use mining crypto, could power the entire Bitcoin network 6.1 times.

So as we get into this we’ll be talking about the relative advantages of different energy sources with respect to crypto mining.

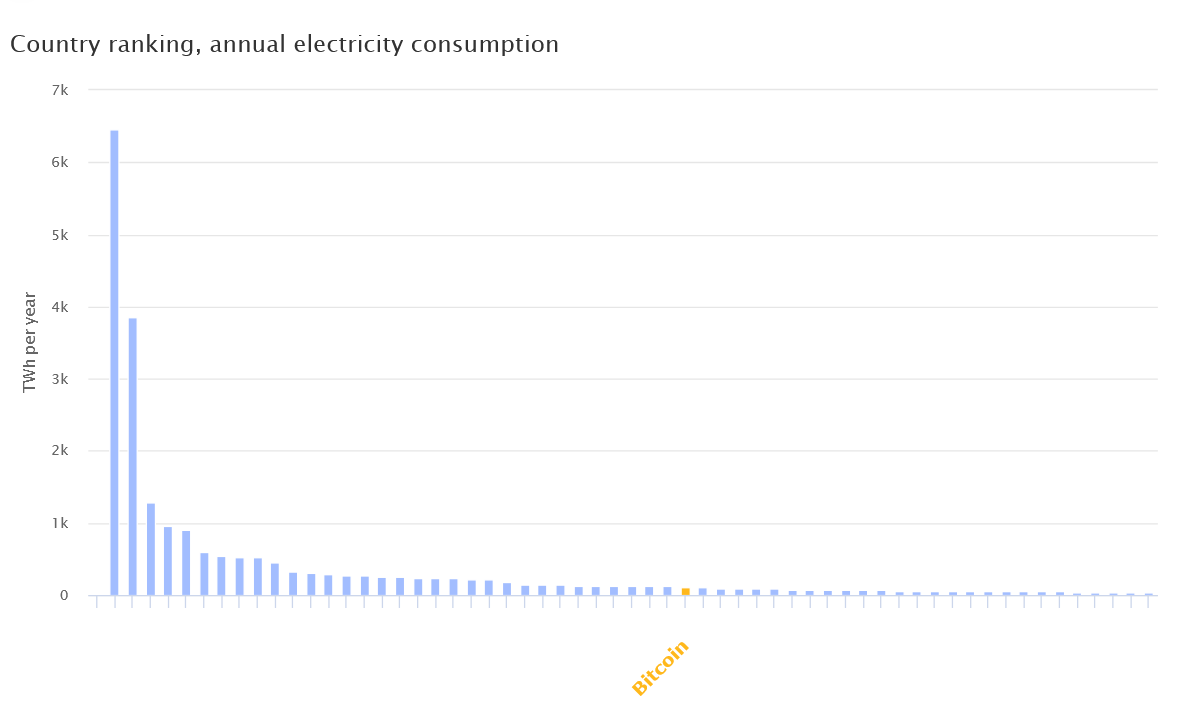

But the main thing we want to do for starters is stop comparing Bitcoin electricity use to electricity use in various small countries, which is just insanely stupid. How much electricity does Bitcoin use? As much as Argentina! Or Sri Lanka, or Jordan. These comparisons with any small country you like are trotted out incessantly, and they are meaningless because the global economy is interconnected. How is it possible to take into account the energy expended in fabricating and transporting all of Argentina’s imports, from cars to machinery to soybeans? If some lady in Argentina buys a car, is the energy used to build that car allocated to Japan, or to Italy, where the car was built? How much of Argentina’s share is burning in China, Brazil and the US? The fact that the names of smaller countries are spouted off in the press without the slightest attempt to determine what these things might mean is an immaculate example of the sloppiness and laziness with which this subject has been covered.

Here’s another graph from CBECI—it’s interactive at the link, scroll to the bottom of the page to see country comparison names, with China and the US being the first two.

It would be a lot more fruitful, for those concerned about runaway emissions, to focus on the wild squanderings of China and the US than it is to get their knickers in a twist about crypto. (Which can help with these problems! as we’ll see.)

In 2018, geography professor Camilo Mora claimed that Bitcoin mining alone could push global warming above 2˚C by 2034—an exciting and terrible prediction that got a lot of people extremely worked up. However, Mora’s methodology and conclusions were discredited the following year in a paper from the Department of Energy’s Berkeley Lab (“Implausible projections overestimate near-term Bitcoin CO2 emissions”), authored by Eric Masanet, a professor at Northwestern, energy analyst Jonathan Koomey, et al. Both papers are online for anyone to examine, and I don’t believe that an impartial observer familiar with blockchain can deny that Mora erred in his assumptions about the correlation between transactions and energy costs, hardware efficiencies, adoption rates etc.

I wrote to ask Masanet’s team if they think Bitcoin is worth the cost in energy. Jonathan Koomey replied: “The people advocating Bitcoin and other cryptocurrencies need to be explicit about what value these new technologies bring compared to other means of delivering the same services.” [emphasis mine]

This strikes me as the best way to frame the discussion. Global energy use is absolutely constrained, everywhere and for the foreseeable future. Widespread blockchain adoption stands to produce energy savings—quite possibly colossal energy savings—and the current hysteria threatens to throw the baby out with the bathwater. What are the true benefits of blockchain, and the true costs?

More on this next time.

p.s. Most of the pearl-clutching regarding Bitcoin energy use originates with one person, Alex De Vries, an energetic but not very sagacious Dutch guy who styles himself “Digiconomist” online. He is famous for exactly one thing: Yelling about how Bitcoin uses too much energy. There are many places where De Vries’s methods have been debunked, but I think the best is by the aforementioned Jonathan Koomey, who is a prof, researcher and energy analyst who spent twenty years working at Lawrence Berkeley National Laboratory. Koomey’s paper, ‘Estimating Bitcoin Electricity Use: A Beginner’s Guide’ is the best and most approachable work on the subject I’ve read so far, and I encourage anyone interested to give it a go.

Boom Times is a blog about gambling, luck, money, greed, investing, blockchain technology and cryptocurrency.