GOP Reps Who Voted Against $2,000 Checks Received Millions in COVID Bailout Funds

After President Trump staked out a position to the left of most congressional Democrats on the size of stimulus checks, the House of Representatives voted on Monday to replace the $600 checks they approved in the COVID relief bill on Dec. 21 with $2,000 checks. Polling from Data for Progress confirms the obvious: seventy-eight percent of likely voters support receiving bigger checks, including majorities from both parties.

Most Republicans voted against the $2,000 checks, but very few of them were willing to speak out against it publicly, as HuffPost noted. Some Republican-aligned political groups, however, did speak out. “This CASH Act will likely increase the debt significantly,” wrote the Charles Koch-funded Americans for Prosperity in a key vote alert that urged reps to vote no. Club for Growth issued a similar key vote alert, writing “this legislation would add hundreds of billions of dollars to the deficit.”

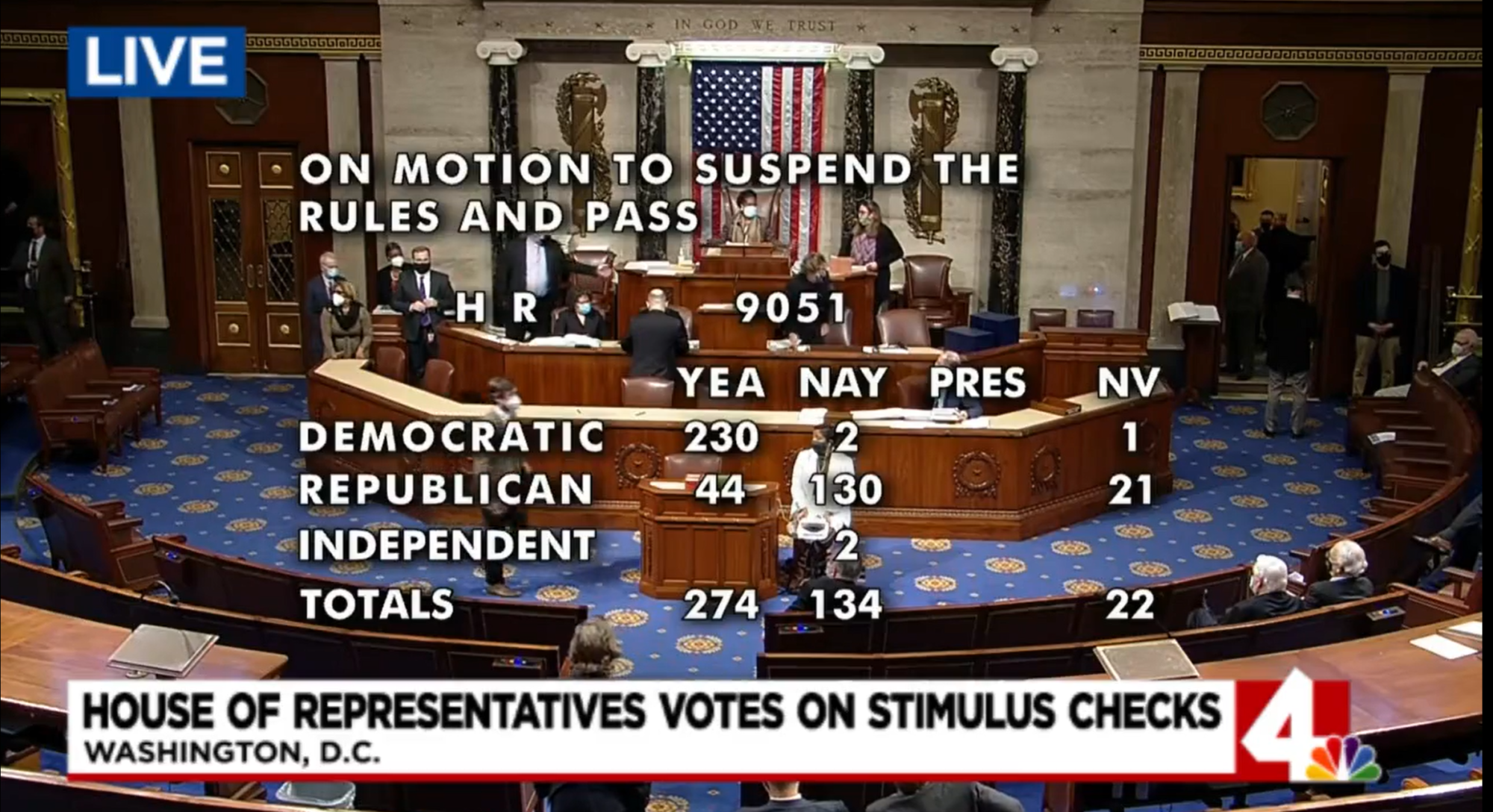

In the end, 130 Republicans voted against the bill, while 44 of them voted for it. Among the 130 Republicans who opposed the larger relief amount for middle-class families, 12 have themselves benefited from much larger government handouts through forgivable bailout loans taken by businesses they own or are affiliated with.

Rep. Devin Nunes (R-Calif.) voted “no” on $2,000 checks after earlier this year taking four Paycheck Protection Program (PPP) loans for his wine and farming businesses totaling $2.95 million. The loans will almost certainly be forgiven under the PPP guidelines, which Congress legislated in the CARES Act.

Nunes is a limited partner of Alpha Omega Wineries and Phase 2 Cellars, and he earns up to $200,000 in annual income from the businesses, according to his most recent financial disclosure. Combined, the two wine businesses received more than $2.3 million in COVID bailout funds.

Another opponent of $2,000 checks who herself benefited from much larger government COVID relief is Rep. Vicki Hartzler (R-Mo.). Hartzler jointly owns with her spouse the Heartland Tractor Company, a Kubota and Case equipment dealership located in Harrisonville, Missouri. The company, which Hartzler values at up to $5 million and which earns her up to $1 million annually in business income, took a PPP loan of $451,000. The president of the bank that approved Heartland Tractor Company’s PPP funding, Hawthorn Bank, has previously been a campaign donor for Hartzler.

The fate of the $2,000 checks is now largely in the hands of Senate Majority Leader Mitch McConnell, who could decide to block the Senate from even taking up the House-passed bill. McConnell is another member of Congress who is tied to a PPP loan.

The family of Transportation Secretary Elaine Chao, McConnell’s wife, owns Foremost Group, a shipping company that operates largely out of state-owned shipyards in China. Foremost Group subsidiary Foremost Maritime Company was approved for a PPP loan of $417,000 by Citibank, whose affiliated PAC has given McConnell tens of thousands of dollars in campaign contributions. Chao and McConnell have been gifted millions of dollars by Chao’s father, who owns Foremost Group, according to the New York Times.

The other House Republicans who voted against $2,000 stimulus checks after their companies took federal bailout funds are Rick Allen, Matt Gaetz, Brett Guthrie, Kevin Hern, Bill Huizenga, Mike Kelly, Carol Miller, Ralph Norman, Brad Wenstrup, and Roger Williams. Libertarian Justin Amash also voted against the bill after his family’s tool company, where he is part owner, got more than $1 million in PPP money. Amash has up to $5.25 million invested in the company and reports earning up to $100,000 from it annually.

Two Democrats voted against the $2,000 checks: Blue Dog Coalition members Kurt Schrader and Dan Lipinski.

Related: Journalists Justin Glawe and Jeremy Borden recently reported at Sludge on the members of Congress who personally benefited from covid bailout programs in the bills passed by Congress. The report is accompanied by a public database of members of Congress’ private affiliations with companies and nonprofits. Here’s a link.

UPDATE: This article previously included Van Taylor, whose 2019 financial disclosure listed a directorship at Churchill Capital. Taylor’s office told Sludge that he is no longer affiliated with the company. Taylor’s office interpreted financial disclosure filing instructions for new members of Congress to mean that they should include positions held in the two years prior to being sworn in, but that rule appear to apply to candidate filings and new congressional employees, but not to new members.