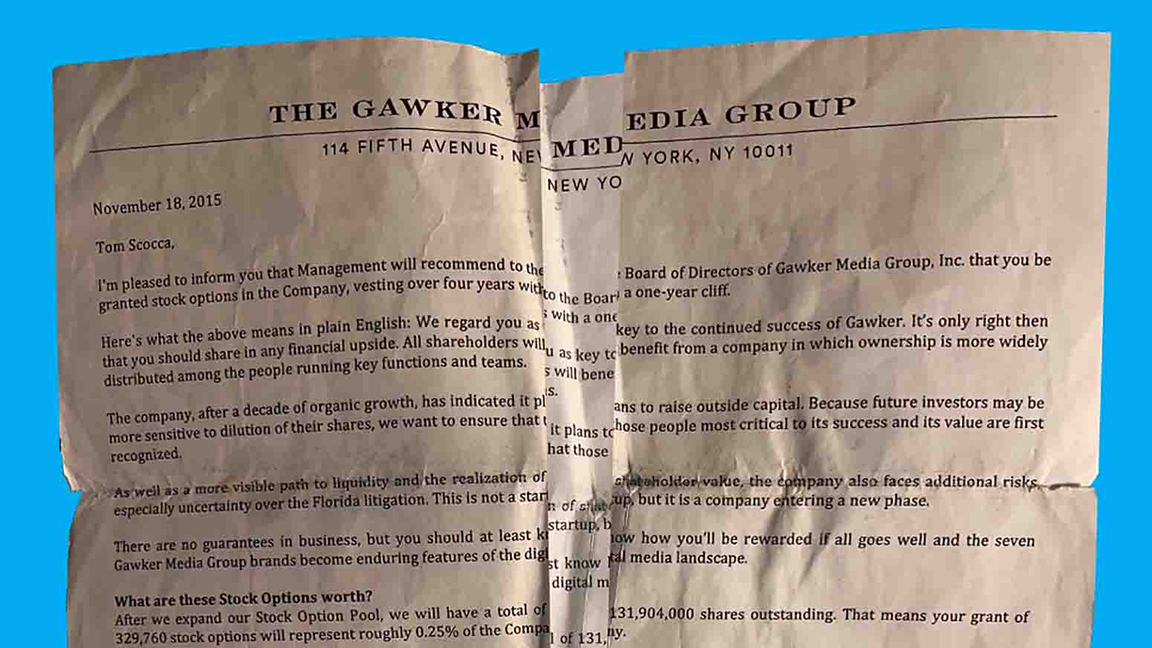

ITEMS OF ANTICIPATED VALUE – Item No. 1: Letter from Nick Denton to Tom Scocca

THE COMMERCIAL AND artistic sensation of 2021 has been the Non-Fungible Token (NFT), a one-of-a-kind digital embodiment of an artwork that is also a secure certificate of its possession. NFTs—sitting as they do at the intersection of art, technology, and finance—have drawn frenzied commercial and media attention, with some of them selling for staggering prices.

Today, Hmm Weekly proudly enters the realm of NFTs with a three-part artistic meditation on financial or technological hope, drawing on our years of experience with the rise and fall of futuristic value-propositions. Our set of NFT artworks, ITEMS OF ANTICIPATED VALUE, records this history of lost possibilities and transforms it into newborn items for this newborn artistic market to evaluate. Own a piece of the past, as it becomes the future!

Item No. 1

Letter from Nick Denton to Tom Scocca

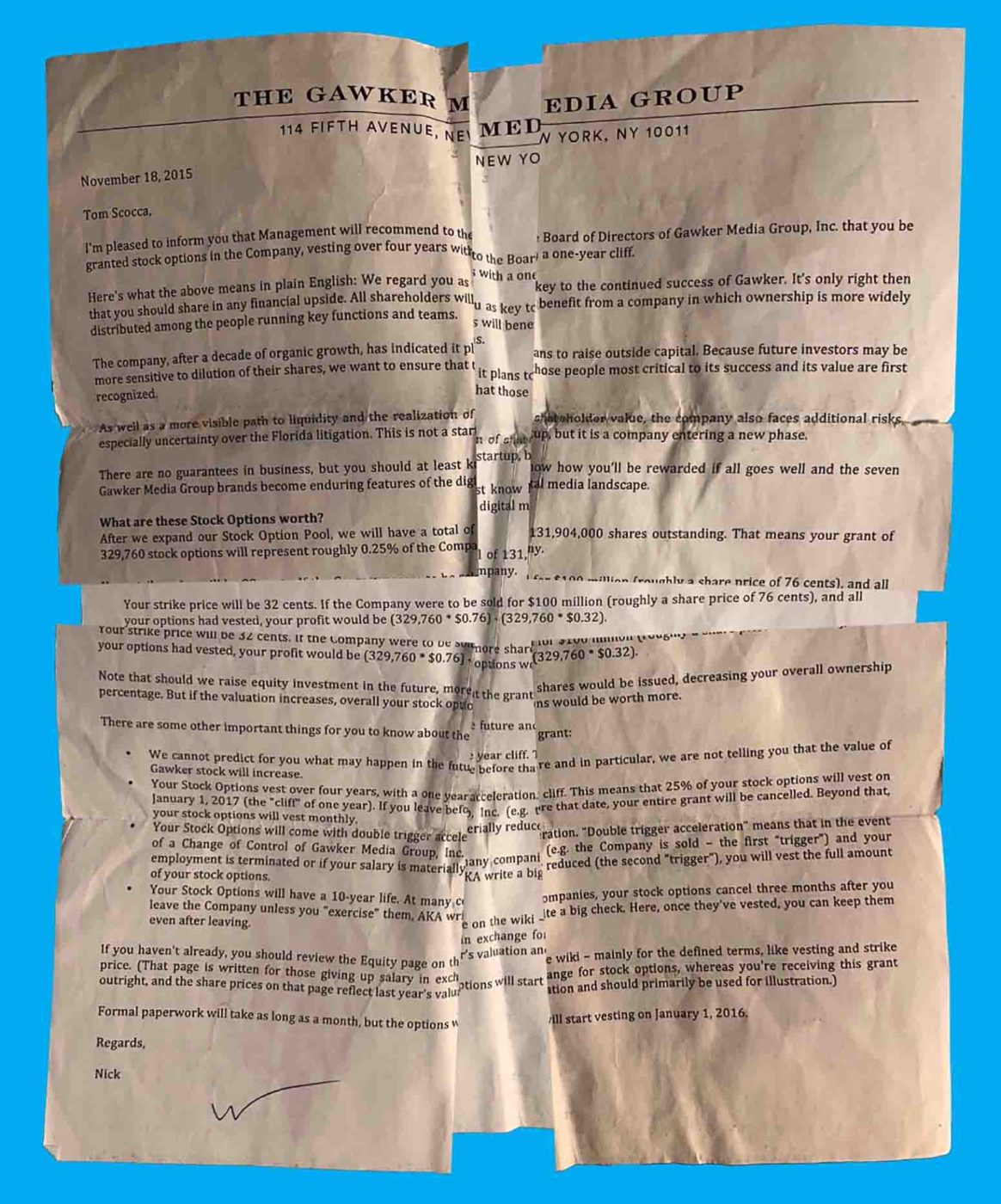

This digital token supplies the buyer with a one-of-a-kind digital copy of a letter from Nick Denton to Tom Scocca, dated November 18, 2015, conveying from Denton to Scocca 329,760 stock options in Gawker Media Group, or 0.25 percent of the company at the time of offer.

The strike price of the shares was 32 cents. In a hypothetical $100 million sale of the company, Denton explains, the profit on the shares would amount to $145,094. Or, more precisely, Denton explains the formula for determining the profit, but refrains from calculating the final number.

In early 2016, before the trial in a lawsuit brought against Gawker Media by the former professional wrestler Terry Bollea, also known as Hulk Hogan—a lawsuit engineered by the billionaire investor Peter Thiel, in retaliation for Gawker Media’s coverage of Thiel and other prominent people in the technology industry—Univision explored the possible acquisition of Gawker Media, with the two companies near agreement at a price of $180 million. Had the deal gone through, the options would have been worth $324,950.

Univision held off on completing the deal, pending the result of the lawsuit. In the trial, a Florida jury awarded Bollea $140.1 million; the trial judge, Patricia Campbell, refused to stay the judgment pending appeal, forcing Gawker Media to declare bankruptcy.

Gawker Media sold its assets, except for the flagship website Gawker.com, to Univision in a $135 million bankruptcy auction. The estate of the company paid $31 million to Bollea to settle the case. The bankruptcy and settlement process rendered the stock options in Denton’s offer letter worthless.

The 0.25 percent ownership in the company went unrealized, but 0.25 percent of the $31 million settlement paid to Bollea would have been $77,500.

The letter is authentic, and the image contains folds and other marks of wear.

[SPECIMEN IMAGE BELOW]

Items in this limited series are offered as part of The Brick House NFT Gala, in support of our journalist-owned cooperative. Please visit the Gala site for more art and artifacts.

Items of Anticipated Value: A Limited Series is a limited series.